Introduction

The introduction of Goods and Services Tax registration for e-commerce websites has proved to be very beneficial in the Indian tax revenue system. This basically marks the beginning of a more streamlined structure. It was implemented in 2017 with the main objective of unifying the fragmented tax structure and fundamentally curbing the tax evasion prevalent in the e-commerce sector. Before GST, e-commerce operators had to face a complex web of taxes, which hindered their business and growth.

GST registration has fundamentally helped in tax collection, benefiting both the consumer and the government to a large extent. Under the GST regime, it is mandatory for e-commerce websites to register for the integrated tax system to provide clarity in taxation across the country. In this article we will tell you what are the documents required for GST registration, what is the eligibility criteria and what is the complete process of registration.

Required Documents for GST Registration

- PAN card of the Company’s Director

- Aadhar card of Authorized Signatory

- Passport size Photograph

- PAN card of Authorized Signatory

- Bank Statement

- Proof of Address

- TCS Detail

- Certificate of Incorporation

- PAN Card of the company

- Memorandum of Association

- Article of association

Registration Requirements Under GST for E-Commerce seller:

Registration Requirements for E-Commerce Sellers Under GST are as given below:

Sellers selling Goods

- All e-commerce sellers who deal with physical products through platforms like Amazon, Flipkart etc. must mandatorily register with the CBIC, even if their turnover is below the limit prescribed by the government.

- Unregistered sellers cannot sell on these platforms without GST Identification Number (GSTIN) for online selling.

Sellers selling Services

- E-commerce businesses that supply services also require registration if their annual turnover is more than Rs 20 lakh.

- Some services like Ola, Uber and Oyo have been exempted from mandatory GST registration under Section 9(5) of the Central Goods and Services Act, 2017

Step-by-step Guide explaining GST Registration Process For E-commerce Sellers:

Step.1) Log in to the GST portal and navigate to ‘ Services ’> ‘ Registration’> then click on New Registration.

Step.2) Fill all the required details and then click on the proceed button.

Step.3) Enter the Mobile and Email OTP and then click on the proceed button.

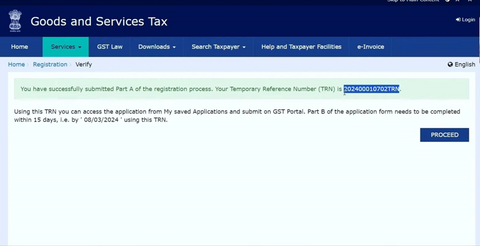

After completing the Part A of the registration process, you will get the TRN number.

Step.4) Fill the TRN Number and Captcha, then click on the proceed button.

Step.5) After filling the Mobile/Email OTP, click on the proceed button. Now, it will show your Saved Application.

Step.6) After clicking on the action button, fill all the required details including Business Detail, Promoter, Signatory Authorized, Authorized Representative, Principal Place of Business, Additional Place of Business, Goods and Services, State Specific Information and Aadhaar authentication.

Step.7) After filling all the required details and validating the final OTP received by you, your application will be successfully submitted

GST Compliances for E-Commerce Sellers:

State Wise Reporting:- All Ecommerce sellers who sell their products to consumers across the country are required to report their taxable amounts and record taxes in each state in which they sell their products as per their respective rates.

- GSTR 1 is required to be filed during a specific period for all outward supplies made by the seller.

Tax Deducted at Source and Tax Collected at Source Credit Claim Return:

- TCS collected from e-commerce sellers by the e-commerce operator is deposited in GSTR 8.

- The TCS amount that the e-commerce seller has deposited with the operator can later be claimed as input tax credit by filing returns by the seller.

Credit Notes and Sales Returns:

- Sales returns by customers are common in e-commerce business, which fundamentally affects the GST liability, sales turnover and ITC credit reversal of the e-commerce seller.

- Therefore, e-commerce sellers should take proper care of keeping accurate records of these transactions while filing GST.

Annual Return GSTR-9 and 9C:

- Businesses whose turnover exceeds Rs. 2 crore are required to file GST annual return in Form GSTR-9, which is an annual reconciliation statement.

- Businesses with a turnover of more than Rs. 5 crore are required to file GST annual return in Form GSTR-9C, which is an annual reconciliation statement

Conclusion

In Conclusion, GST has created a conducive environment for e-commerce growth by integrating various state and central taxes into a single system. As we know transparency has increased to a great level with GST registration. As the ecommerce sector continues to grow, GST registration will play a vital role in contributing to its resilience. Getting GST registration proves to be very beneficial for e-commerce, it basically helps them in getting out of the complex web of taxes. In this article we told you what is the eligibility for GST registration and how you can apply for GST registration.