At least for all businesses registered with the Goods and Services Tax (GST) in India, filing the GSTR3B return is mandatory. Businesses use the GSTR 3B Form to declare their summarized tax liability for the period and to claim input tax credit (ITC) on purchases. But just filing the GSTR 3B is not enough. It should also be downloaded for record-keeping and compliance purposes.

Whether you’re an experienced business owner or just starting out, this guide will walk you through the simple steps of downloading GSTR3B from the GST portal. By the end of this post, you’ll be able to access and save your GSTR3B form quickly and efficiently.

What is GSTR3B?

Take a moment to understand GSTR3B before we begin. Every registered GST taxpayer must file GSTR3B, the summary return. Businesses file the summary return, which informs about details of outward or inward supplies and tax liability. By filling out this return, businesses are able to have relief from penalties and also ensure Indian tax compliance.

So with this vital document in mind, let's take you through the three easy steps of downloading it.

Step-by-step Guide to Downloading GSTR3B

Here’s a simple walkthrough for downloading your GSTR3B form from the GST portal:

Step 1: Log in to the GST Portal

Accessing the GST portal is the first step in downloading your GSTR3B. Follow these simple steps to log in:

- Go to the GST portal: Open your browser and visit the official GST website: https://www.gst.gov.in/.

- Click on “Login”: On the top right corner of the homepage.

- Provide credentials: Type your user name, password, and the Captcha code. Then, click Login.

- Dashboard: You will be taken to your very own dashboard once you have logged in. Here you can handle all GST related activities.

Step 2: Go to the Returns Dashboard

Once logged in, you want to get back to the Returns Dashboard, where you can see all your previous filings.

- Go to “Services”: In the top navigation bar, click on the Services tab.

-

Click Return: Drop down -> Returns page Find the Returns dashboard.

- Select Filing Period: After clicking on this, you will be taken to the File Returns page, under which you have to provide the Year and return filing period (month) and press on Search.

- Press Search: Click on the search button to view filed returns for the selected period.

At this point, all the returns filed for that specific period will be displayed on your screen.

Step 3: Download the GSTR3B Form

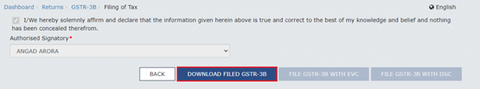

Now that you’ve located your filed return, it’s time to download it. This is the simplest part of the process.

- Select GSTR3B: Go to Return Dashboard and click on Services. You submitted GSTR3B for entry. Beside it, there should be a status of either Filed or Submitted.

- View Filed Returns: Click on the View Filed Returns button. This will take you to a new page where you can see a detailed summary of your GSTR3B filing.

- Download the form: On this page, you can choose to download it in PDF or Excel format. You can save the form to your device by simply clicking on the Download button.

Why should you download GSTR3B?

Downloading your GSTR3B return is not just a formality. Here are a few reasons why it’s essential:

- Audit Preparation: The government may audit your business, and having a copy of your GSTR3B on hand will make the process smoother.

- Cross Verification: It’s a good idea to verify your filed return against your internal records to ensure no discrepancies.

- Future Reference: For financial analysis or GST claim purposes, you may need the form. Storing your return in a safe place ensures you have quick access when needed.

Common Issues While Downloading GSTR3B

Though the process is relatively simple, it can cause problems in triggering the GSTR3B download for a few users. Here are common issues and fixes:

- Forgotten Login Credentials: Many users forget their login details. If this happens, use the “Forgot Username” or “Forgot Password” options on the GST portal to recover your information.

- Selecting the wrong period: Make sure you’re choosing the correct financial year and month when searching for your returns. Selecting the incorrect period could lead to the display of no data.

- Technical Glitches: The GST portal may experience technical issues, especially during filing deadlines. If you face slow performance or errors, try accessing the portal during off-peak hours.

FAQs About GSTR3B

1. How frequently should I download my GSTR3B return?

It’s a beneficial practice to download your GSTR3B every time you file a return. Having a copy ensures that you’re prepared for audits and compliance checks.

2. Can I download GSTR3B returns for multiple months at once?

Unfortunately, the portal does not allow bulk downloads. You’ll need to download each month’s return individually.

3. What should I do if I can’t find my GSTR3B return for a specific period?

Double-check that you’ve selected the correct financial year and return filing period. If the issue persists, contact the GST helpdesk for assistance.

4. Is there a deadline to download the GSTR3B return?

There is no deadline to download the return. However, it’s recommended to download it as soon as possible after filing for your records.

5. Can I amend my GSTR3B after filing?

No, once filed, GSTR3B cannot be amended. Subsequent months' returns must incorporate any necessary corrections.

Conclusion

Why is it crucial for your business to maintain accurate records and comply with GST? At first glance, the process may seem complicated, but breaking it down into these basic steps makes it easier to build. This enables you to easily download your GSTR3B return and meet all of your GST compliance deadlines.

Be sure to save all of your downloaded returns for later use. This will save you time and hassle during audits or compliance checks.

So, the next time you download your GSTR3B returns and scrutinize it well, at least now you can have the assurance that whichever business that place in scenario would not be yours.